MMI Holdings | Corporate Profile

2015

www.mmiholdings.com

Contents 2 Our Roots 4 Embracing Client Centricity 6 Our Vision and Purpose 8 Our Values 10 Group Overview 14 Our Structure 18 Our Brands 22 Corporate Social Investments 26 Sustainability 28 Transformation 30 Our Sponsorships 32 Our Achievements 34 Contact Details 1

Our Roots 2

MMI Holdings Limited (MMI) is one of the largest insurance-based financial services groups listed on the South African stock exchange, the JSE. MMI was formed on 1 December 2010 from Solutions. the merger of Metropolitan Holdings and the These products and solutions are provided Momentum Group, both sizable insurance- through segment businesses which focus on based financial services players in South understanding and fulfilling the needs of Africa. The merged group now has a market specific client segments. The segments, capitalisation of R42 billion and an embedded Metropolitan Retail, Momentum Retail, value of some R39.7 billion International, and Corporate and Public (as at 30 June 2014). Sector, deliver solutions that meet clients’ financial wellness needs through appropriate MMI has five Product and Solutions Centres distribution and service delivery channels. of Excellence which develop appropriate offerings for our clients. These centres are: Investments and Savings Solutions, Life Insurance Solutions, Health Solutions, Legacy Solutions, and Short-term Insurance 3

Embracing Client Centricity MMI Group CEO, Nicolaas Kruger, recently sat down with leadership analyst, consultant and columnist Gareth Armstrong, to discuss MMI and the reason for its success. This is an edited version of the article that first appeared in Independent Newspapers’ Business Report in August 2014. 4

“One of the objectives of the merger between When I asked Kruger about how he dealt with Metropolitan and Momentum in 2010 was to save creating a holding company team and board, trust ZAR500 million in costs, and that we accomplish this was at the centre of it all. “During the negotiation ahead of schedule. We’ve been able to merge six phase of the merger we would on occasion find different product businesses, while retaining an ourselves across the table from each other as extremely high percentage of senior management. adversaries. The quickest way to trust each other There is always concern over client retention during was to trust one another’s intent. If you trust the something like this, but our numbers remained other party’s intent, you can still move forward.” solid, and if we use our MMI share price plus dividends as an indication of our growth, it is more MMI is now pushing forward with a strategy where than double what it was at the time of the listing.” its clients find themselves at the heart of some interesting structural changes that require strong What does Kruger feel his team and the group internal partnerships and high levels of teamwork learned from the last few years? He shares: and trust. “The first thing is that going into something as stressful as this, you must have a strong business “We like to give recognition to teams. case. But it must be as strong strategically as it is on We also try keeping things a little less paper when looking at the numbers.” In other words, one plus one must equal three. “While it is formal here, and to develop an an absolute must for the strategic rationale and environment where people can feel at numbers to add up, it is the softer issues that are home, can be heard, where mistakes most difficult to deal with.” can be tolerated and where innovation “A huge part of our success has been very proactive happens. It’s about adding value and stakeholder management. Even if you can’t give all removing barriers.” the answers, just the fact that you are engaging with them and they feel you are hearing what they are No one man or woman will be able to claim credit saying is important.” for MMI’s successes going forward. Kruger shares: “We like to give recognition to teams. We also try Kruger stresses the importance of putting the right keeping things a little less formal here, and to people into the correct roles. MMI had to bring six develop an environment where people can feel at customer facing business divisions together; one of home, can be heard, where mistakes can be their most challenging undertakings by far. “What is tolerated and where innovation happens. It’s about important in a merger is ensuring that there adding value and removing barriers.” remains integrity in the selection processes. If people sense favouritism taking place, or With the organisation now divided into four inconsistent adherence to process, that can Segment Businesses that identify client needs, undermine the spirit of the merger. So we spent a Products and Solutions Businesses that will focus on lot of time evaluating, assessing, interviewing, and delivery, and newly consolidated group-wide matching skills and capabilities to roles and support functions, MMI is positioned well to functions.” respond quickly to its clients and deliver products that supply their needs and solve their problems. As important as skills and capabilities are, the aspirations of the soon to be appointed executives Time will tell whether or not Kruger and his team need to be understood as well. Fallout is another have made the correct decision to restructure this essential risk to manage, says Kruger: “As important organisation, but with high staff morale and low as it is to choose the right person, it is also very attrition rates, a solid and loyal customer base, and necessary to have a process in place for those not strong leadership with a clear sense of where they chosen. They are still very valuable and you must do are headed, it seems that MMI may be worth having all you can to retain them in other appropriate in one’s investment portfolio. roles.” 5

Our Vision and Purpose 6

MMI has embraced the shift towards a client-centric strategy and operating model. Client-centricity defines the existence of our organisation, which is to enhance the lifetime financial wellness of people, their communities and their businesses. Underpinning the execution of our strategy Our Vision and the implementation of our operating To be the preferred lifetime financial wellness model is our continued objective of partner, with a reputation for innovation and connecting meaningfully with clients, and trustworthiness. being a good corporate citizen. We aim to make a difference in society, and to make Our Purpose our world a better place. The essence of our To enhance the lifetime financial wellness existence is to enhance financial wellness. In of people, their communities and their the current business reality, these imperatives businesses. are fundamental to our sustained success. Our Strategic Focus Areas Growth Client Centricity Excellence 7

Our Values 8

MMI is a values-based organisation. As a young company, six values guide our actions, intent and shape our culture and commitment to excellence. Accountability Innovation We show accountability in our willingness to We thrive on innovation by challenging take ownership for our roles, responsibility for ourselves to find better solutions, our actions and outcomes, and by honouring continuously improving our processes and our obligations to all stakeholders. growing our people. Diversity Integrity Throughout our organisation we embrace and We uphold integrity in living up to what we promote diversity, together with the many say, doing the right thing, being honest and talents and skills our employees bring from treating all people with respect. different backgrounds and perspectives. Teamwork Excellence Through teamwork, we support each other We strive for excellence in everything we by listening, collaborating, encouraging and do, by delivering the highest standard of respecting each other in our quest to achieve products, service and performance to all mutually beneficial results. stakeholders. 9

Group Overview MMI in numbers (as at 30 June 2014) 10

Market capitalisation ZAR 42 billion Embedded value ZAR 39.7 billion Capital buffer ZAR 3.2 billion Credit rating (MMI Group Limited) IFS AA+ (zaf)/stable Sub-debt A+ (zaf) Total staff 16 692 Indoor 9 877 Field 6 815 International 2 276 Broad-Based Black Economic Level 2 contributor Empowerment contributor (Financial Sector Charter) 11

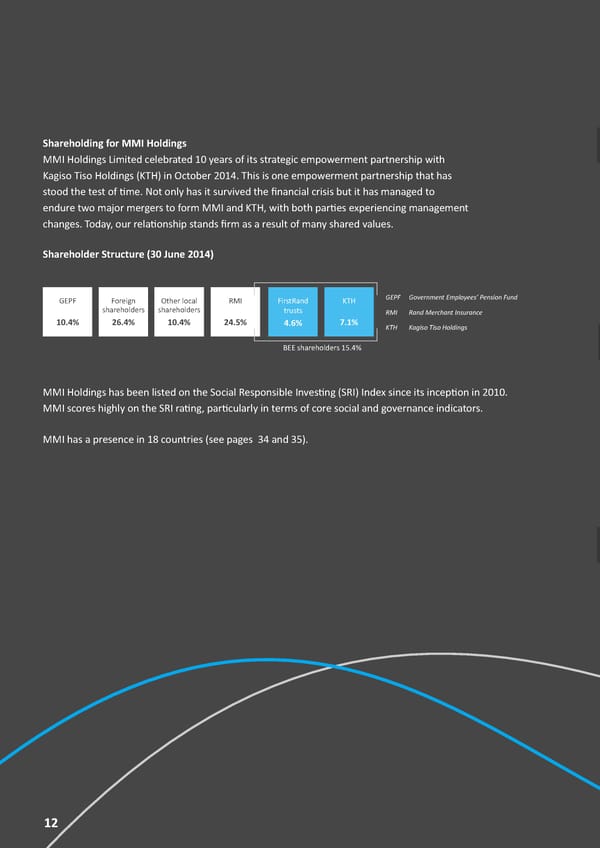

Shareholding for MMI Holdings MMI Holdings Limited celebrated 10 years of its strategic empowerment partnership with Kagiso Tiso Holdings (KTH) in October 2014. This is one empowerment partnership that has stood the test of time. Not only has it survived the financial crisis but it has managed to endure two major mergers to form MMI and KTH, with both parties experiencing management changes. Today, our relationship stands firm as a result of many shared values. Shareholder Structure (30 June 2014) GEPF Foreign Other local RMI FirstRand KTH GEPF Government Employees’ Pension Fund shareholders shareholders trusts RMI Rand Merchant Insurance 10.4% 26.4% 10.4% 24.5% 4.6% 7.1% KTH Kagiso Tiso Holdings BEE shareholders 15.4% MMI Holdings has been listed on the Social Responsible Investing (SRI) Index since its inception in 2010. MMI scores highly on the SRI rating, particularly in terms of core social and governance indicators. MMI has a presence in 18 countries (see pages 34 and 35). 12

MMI Group Executive Committee Operating Businesses CEO Products & Solutions Group Wide Functions Preston Speckmann Chief Financial Officer 13

Our Structure 14

MMI Holdings has built an operating model and structure that supports its strategic focus on client centricity. The operating model and structure underpins MMI’s defined purpose to enhance the lifetime financial wellness of people, their communities and their businesses. The model and structure organises MMI Holdings’ activities around clients. It separates MMI group activities into: segment businesses; a products and solutions business; client engagement solutions and group-wide functions. Segment Businesses Client Engagement Solutions Product and Solutions Business Metropolitan Retail Multiply Rewards Investments and Savings solutions Momentum Retail Financial Wellness Life Insurance solutions International Data Analytics Health solutions Corporate and Public Sector Legacy solutions Short-term Insurance solutions Group-wide functions Group Finance Group Balance Sheet Risk Management Brand and Strategic HR and Infrastructure & Management Corporate Affairs Transformation Operations (BSM) The segment businesses are made up of Metropolitan Retail, Momentum Retail, Corporate and Public Sector, and International. The Client Engagement Solutions area optimises client engagement capabilities and ensures an appropriate focus on this critical part of MMI’s strategy. The Products and Solutions business focuses on designing and developing solutions to fulfil the needs of clients identified by the segment businesses. Group-wide functions include Group Finance, Brand and Corporate Affairs, Strategic Human Resources and Transformation, Risk Management and Group Infrastructure and Operations. 15

Segment Businesses The key focus of the MMI strategy and its structure is on building relationships with clients by integrating financial wellness solutions into our engagement with clients. This will allow a deeper understanding of our clients’ needs, circumstances, and preferences thereby allowing MMI to design, deliver and manage holistic lifetime solutions that integrate multiple products and services to guide our clients towards financial wellness. Metropolitan Retail Focuses on understanding and meeting the financial wellness needs of consumers in South Africa’s lower income segment. The business is also responsible for client interaction and manages the distribution channels and client service capabilities relevant to their clients. Khanyi Nzukuma Momentum Retail Focuses on understanding and meeting the financial wellness needs of consumers in the South African middle to upper income segments. It is responsible for all interaction with clients in these segments, using the distribution and service channels relevant to middle-to-upper income clients. Mark van der Watt Corporate and Public Sector Serves the financial wellness needs of medium-to-large group clients in the corporate and public sector segments. The business also manages the distribution channels used to interact with clients in these two segments, using either the Herman Schoeman Momentum, Metropolitan or Guardrisk brand, depending on which is most appropriate to the particular client or sub-segment. International Follows a multiple approach in entering new markets including emerging countries such as outside South Africa and further afield such as India. The business is responsible for identifying opportunities for leveraging our Blum Khan financial wellness proposition across multiple segments of the countries where we are represented through multiple distribution channels and using the client- facing brand appropriate to the country. 16

Products and Solutions business Designs solutions to meet the financial wellness needs of clients identified by the segment businesses. It was created to establish a single investment capability within the group to align with our outcomes-based investment philosophy. Etienne de Waal Group Finance & Balance Sheet Management Preston Speckmann Responsible for the overall financial and balance sheet management of MMI. This includes financial reporting, governance, company secretariat, financial position of shareholders, capital management, corporate action, strategic funding, asset- liability matching and group treasury. Mary Vilakazi Strategic HR and Transformation Responsible for aligning the human resources strategy and initiatives with MMI’s strategy and operating model, and to co-ordinate MMI’s Broad-Based Black Economic Empowerment (B-BBEE) rating process. Ngao Motsei Risk Management Responsible for the co-ordination of all risk management activities throughout MMI. It comprises a multi-disciplinary group of people across MMI working towards effective risk management, and covers all risk types - insurance (including the Jan Lubbe statutory actuary), credit, market, operational and compliance risks. Brand and Corporate Affairs Incorporates brand, stakeholder relations, sustainability, corporate communication and corporate social investment. Brand functions are centralised for a more integrated brand strategy for all brands within MMI. MMI will continue Vuyo Lee to leverage MMI’s strong client-facing brands, including new additions to our portfolio of brands. Group Infrastructure and Operations Responsible for steering MMI’s new operating model, the division is also responsible for ensuring a secure, sustainable and relevant infrastructure and technology environment that enables the business to achieve its goals. Danie Botes 17

Our Brands 18

Metropolitan is one of the oldest financial services brands in South Africa. With a 116 year legacy of serving the communities in which it operates, Metropolitan represents true empowerment in serving Africa’s people through affordable financial solutions that create financial growth and security. Metropolitan operates in South Africa, but the brand is also present in 12 African countries including, Namibia, Botswana, Kenya, Ghana, Nigeria, Lesotho, and Swaziland. Metropolitan provides financial wellness solutions including funeral insurance, health, savings, hospital cash-back cover, retirement solutions and life insurance. Known for its entrepreneurial spirit and culture, Momentum is one of the most aspirational brands in South Africa. Originally established in 1966, Momentum has grown over the years to become one of the most recognised financial services brands in South Africa for wealth creation and preservation. The Momentum brand is known for satisfying the wealth creation and preservation, insurance and income needs of clients through their deep understanding of the retail insurance, savings and investment market in South Africa. Eris properties is a property development and services group which provides a range of commercial property skills in the South African and sub-Saharan African markets. MMI Holdings became a major shareholder (52 percent) in Eris Properties in 2012. Eris also manages MMI’s property portfolio of R6.6 billion. Eris was formed in 2008 following the restructure of RMB Properties which had been in existence since 1987, and which was a prominent property development and property services company in the South African property industry. 19

Guardrisk is the largest specialist cell captive insurance group of its kind and the leading alternative risk transfer provider in South Africa, comprising a short-term insurer, life insurer and an underwriting manager. Guardrisk pioneered the cell captive concept, introducing cell captives to the South African short-term insurance industry in 1993 and extending the structure to the life insurance industry in 1999. Guardrisk provides structured insurance products, traditional cell captive facilities and access to a broad and diversified panel of related services and professional reinsurance markets through its businesses in South Africa (headquarters), Mauritius and Gibraltar. The Gibraltar operation consists of Euroguard, a leading Protected Cell Company providing alternative risk financing facilities in first party only cell captive structures. Guardrisk Allied Products and Services offers niche and general commercial insurance products across a variety of insurance classes, along with other related value add products that provide facilities like car hire, monthly premium instalment payment facilities and cash flow and factoring solutions. Multiply’s wellness and rewards programme is the primary engagement platform that MMI uses to connect with clients to encourage both financial and physical wellness. Multiply rewards members for doing the everyday things that ensure a healthy and happy life. Through Multiply, MMI clients gain access to physical and financial fitness partners and tools at discounted rates, making it easier to follow a physically and financially healthy lifestyle. MMI clients earn Multiply points for using these partners and tools to look after their wellbeing and enjoy great discounts on a wide range of products and services. Earning more points improves clients’ Multiply status, which provides access to even greater discounts. 20

hello doctor Hello Doctor is a mobile health service that provides preventative care and gives people the ability to connect with a doctor to make informed decisions about their health and wellness. The Hello Doctor interactive platforms are designed to give instant access to personalised health, wellness and medical information – all reviewed and approved by a team of doctors. Established in 2009, Hello Doctor is available in South Africa across multiple portals and social media platforms. The service is also being rolled out across Africa in partnership with mobile service provider MTN. Hello Doctor’s stated purpose is to: connect technology, first world clinical protocols, and medical professionals to assist every person take control of their health and wellness, affordably and simply. The acquisition of CareCross Health Group, including a majority share in Occupational Care South Africa (OCSA) was finalised in November 2014. Since inception in 1998, CareCross has focused on delivering affordable healthcare through provider networks. The company, with a national network of around 2 000 General Practitioners and 4 000 associated healthcare professionals such as specialists, dentists and optometrists, currently delivers managed care and administration services to approximately 200 000 medical scheme beneficiaries. OCSA is widely considered a market leader in workplace health and wellness solutions. Through a joint initiative with OCSA, CareCross delivers integrated occupational health solutions to approximately 55 000 workers nationally. The acquisition of CareCross extends the ability of MMI and its Health Solutions business to offer holistic solutions to existing and prospective clients, reinforcing MMI’s commitment to client centricity. 21

Corporate Social Investment 22

MMI Foundation The MMI Foundation, the Corporate Social Investment (CSI) arm of MMI Holdings, was set up to distribute CSI funds to non-profit organisations and institutions working towards the development and empowerment of the broader community. The Foundation achieves meaningful interventions in the areas of health, education, disability and sports development in South Africa. The MMI Foundation provides strategic socio-economic development by partnering oversight to, and funds the CSI initiatives of with Government, non-profit organisations MMI brands but mainly Metropolitan and and the community at large in the selected Momentum. Metropolitan and Momentum focus areas of health, education, disability have historically played an important role in and sports development within South Africa. the socio-economic development of various The commitment to social giving means that communities and have long standing CSI the MMI Foundation is continually looking programmes. for new ways to increase its impact and reach in disadvantaged communities. The aim is to The Foundation is a vehicle through which improve the delivery of both relevant and MMI Holdings fulfils its commitment to sustainable solutions to all beneficiaries. 23

Metropolitan CSI Metropolitan’s CSI objectives are guided by the principles of collaborative partnership, engagement, long- term sustainability, relevance and a commitment to ‘rolling up our sleeves’ and working together. This is achieved through facilitating programmes that enable the improved quality of life for all. Metropolitan has three primary CSI focus areas: Health Metropolitan supports interventions that address healthcare burdens such as accessibility to healthcare in rural and township communities; and projects that address awareness, treatment and care of diseases such as HIV/AIDS, tuberculosis, as well as lifestyle diseases. Education Metropolitan supports interventions that address the improvement of a learning environment to influence the delivery of quality education and the provision of financial education to rural communities. Sports Development Metropolitan supports sporting initiatives in townships and rural communities that contribute to the empowerment and development of youth. Momentum CSI Momentum believes that well-structured, impactful social investment has the ability to contribute positively to nation building and to drive positive change in the communities that Momentum operates in. Momentum’s CSI focus areas are: Disability Momentum’s programme for people with disabilities is focused on helping people living with disabilities to cope better in life by supporting their abilities and capabilities, whilst encouraging and enabling society to be more inclusive of people living with disabilities. There is a focus on access and the quality of education and care; prevention – especially secondary prevention in the form of early intervention; and overall inclusion. Education Through its education programme Momentum supports interventions that address the effective delivery of quality education and/or the improvement of resources. This is with the aim of ensuring adequate structures are put in place for an improved and educated South Africa, to ultimately empower our people to make better decisions in their daily lives. Sports Development This is the support of grassroots interventions for sporting achievement and personal development which address empowerment of South Africans. Specific support includes projects that address sports development, youth development including life skills, and community development activities. 24

Guardrisk CSI Guardrisk’s social ethics and transformation committee engages the company’s social responsibility committee, known as Lebone (a Sotho word meaning “the light”), to enhance the operations, formalise its activities and maximise social impact. Lebone provides Guardrisk employees with the opportunity to become involved with worthwhile projects and give of their time and resources to previously disadvantaged communities. Guardrisk has partnered with Marsh in the Adopt a Motor Body Repairer project to help make disadvantaged black-owned motor body repairers competitive and sustainable; enabling them to enter the supply chains of the short-term insurance industry and the broader motor body repairers market. Guardrisk has also entered into an enterprise development arrangement where it provides operational support in the form of office premises and facilities to Surenet, a small black-owned financial services firm that specialises in the distribution of assistance policies to the previously underserved market. Eris Property Group CSI Eris has a CSI committee that facilitates the company’s corporate social investment. A budget is allocated every year to the committee which evaluates proposals sent to the company, as well as source worthy and sustainable causes the company can support. Most recently, Eris provided assistance to schools in underprivileged communities, orphanages, animal shelters and other non-profit organisations through funding and volunteering. 25

Sustainability 26

MMI Holdings is fully committed to the principles of sustainability. We strive to be financially sound, socially responsible as well as environmentally friendly, with good corporate governance as the overarching principle. We believe that sustainability is an approach Accessibility to business that places value creation in a Enhancing the accessibility of financial long term context. Implicit in this statement solutions, financial literacy and encouraging a is the creation of shared value. This implies savings culture that economic value is created for the business whilst simultaneously creating Responsible investment value for society, which enables the needs Considering sustainability criteria in our and challenges of society to be addressed. investment decisions We believe business success should be linked to socio-economic development and Celebrate our values low environmental impact. Sustainability Transforming, changing culture and creating is an approach to business that takes all synergies which link to the MMI values three elements, economic, social and (accountability, diversity, excellence, environmental value, into account. innovation, integrity and teamwork) We have identified the following areas as key Stakeholder management sustainability issues and have incorporated Ensuring that stakeholder concerns are them into our business. addressed Governance Applying best corporate governance standards Efficiency Managing our processes and our environmental footprint 27

Transformation 28

Transformation remains an important pillar in realising our vision to be the preferred lifetime financial wellness partner, with a reputation for innovation and trustworthiness. In 2013, MMI was one of the few organisations that were benchmarked against the Financial Sector Charter (FSC) codes and we were able to maintain our level two Broad-Based Black Economic Empowerment (B-BBEE) contributor status. The table below illustrates MMI’s B-BBEE performance against FSC targets: B-BBEE element MMI FSC Performance 2013 Equity ownership 15.88 Management control 7.82 Employment equity 9.8 Skills development 7.13 Preferential procurement 12.8 Enterprise development 15 Socio-economic development 3 Empowerment financing *Exempt Access to financial services *Exempt Total score 88.19 B-BBEE rating Level 2 *Enhanced recognition due to the exemption of empowerment financing and access to financial services. 29

Our Sponsorships 30

MMI has various sponsorships to enhance awareness of our brands and support the group’s focus on ensuring financial wellness. Metropolitan development soccer sponsorship Metropolitan has been supporting soccer development for over 25 years, aimed at community development and engaging with the people who do business with us. We currently sponsor the Metropolitan U19 Premier Cup (MPC) held in Cape Town. Clash of the Choirs Clash of the Choirs is a musical show that draws interest from Metropolitan’s target market. It is important for us to connect with our clients at this touch point, and also drive top-of-mind brand awareness. We are proud to be involved in an initiative that resonates so deeply with our market, and to connect with them on this passion point. Regional sponsorships Metropolitan also supports a range of regional sponsorships in different provinces to enhance the brand’s presence and commitment to grassroots development. We support the Eastern Cape Choral Music Awards, the North West Caddies Golf Day and the South African National Defence Force (SANDF) Goodwill Parcel Project in Gauteng. Cricket sponsorship Momentum is the official single-title sponsor of all one-day cricket matches under the jurisdiction of Cricket South Africa (CSA). The sponsorship includes ongoing development at provincial and grassroots level through supporting national club championships and bursaries to talented high school cricketers. Momentum 94.7 Cycle Challenge The race encourages all cyclists to make a difference by attaching a social responsibility goal or component to their cycling experience. Momentum UNISA Financial Wellness Index Researched and presented in collaboration with the University of South Africa (UNISA), this information helps financial service professionals and consumers to better understand and interpret the current state of financial wellness of South African households. It also provides policymakers with insights needed to improve the financial wellness of households. Momentum and Pick n Pay – a unique partnership Momentum is now partnering with retailer Pick n Pay on several of its sponsorship initiatives including the Cape Town Cycle Tour, Knysna Oyster Festival, the Pick n Pay Women’s Walk series and the Pick n Pay Marathon - sharing its brand vision of enhancing the financial wellness of South Africans with more than 430, 000 participants across all events. 31

Our Achievements 32

Momentum Retail - Hamlet Foundation Outstanding Achievement Award for work with people with intellectual disabilities Metropolitan Retail - Second position in the Sunday Times Top Brands for the long-term insurance industry category Momentum Employee Benefits - PMR golden arrow for group life/risk products; group pension and provident funds; and investment products Metropolitan International - Metropolitan Zambia: Wanthanzi Health Plan was awarded the PMR Golden Arrow award for their significant contribution to stimulate economic growth and development in Zambia - Metropolitan Namibia received the PMR Silver Arrow award for its contributions towards economic growth and development in Namibia Momentum Health - PMR Golden Arrow award for health care administration and Diamond Arrow for Large Pension Fund Administrators and product providers: Insurers Momentum Short-term Insurance - Best Small Car Insurance Company for 2013, by carinfo.co.za - Achieved the lowest overturn rate (10% vs. industry average of 33%) of complaints logged with the Ombudsman for short-term Insurance during 2013 Eris Properties - IPD Property Investment Award - Top property fund in databank for market sector: Industrial, Fund name: Metropolitan Life Properties - 5 star green rating award for Portside building in Cape Town - 4 star green rating award for 102 Rivonia Road building in Sandton, also shortlisted at the World Architecture Festival held in Singapore in the category: Future Commercial Office - Winner of Fulton Award for Innovative Construction for Menlyn Podium Building, Tshwane Momentum Asset Management - Momentum Global Investments Management won the Financial News award for Frontier Markets Manager of the Year - Mishnah Seth from Momentum Asset Management ranked in the top 10 Africa fund managers category in the Africa AM Power 50 awards - Momentum Asset Management ranked fourth in the top investment company category in the Sunday Times Top Brands survey - Momentum Money Market Fund awarded an ‘AA+(zaf)’ National Fund Credit Rating and ‘V1(zaf)’ National Fund Volatility Rating by Fitch Ratings Agency. This is the highest money market fund rating that a money market fund can achieve in South Africa 33

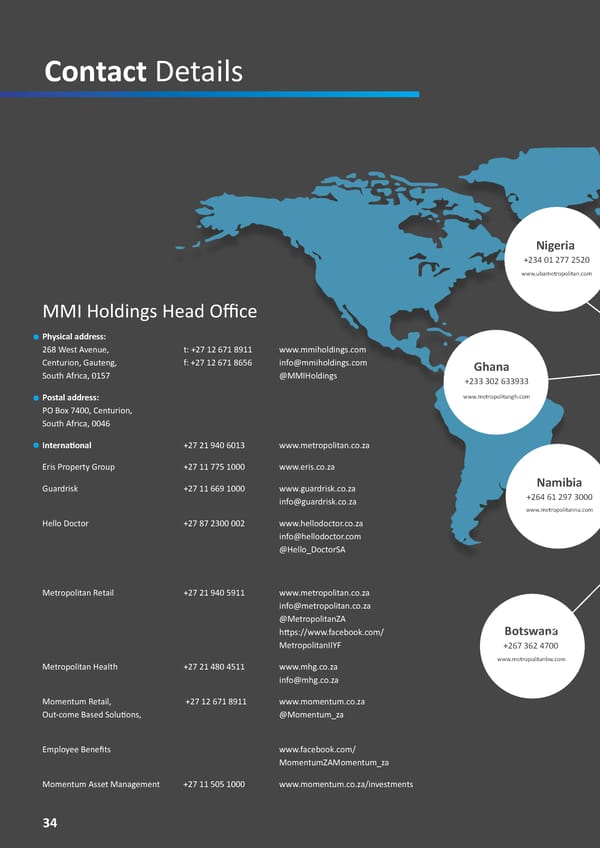

Contact Details Nigeria +234 01 277 2520 www.ubametropolitan.com MMI Holdings Head Office Physical address: 268 West Avenue, t: +27 12 671 8911 www.mmiholdings.com Centurion, Gauteng, f: +27 12 671 8656 [email protected] Ghana South Africa, 0157 @MMIHoldings +233 302 633933 Postal address: www.metropolitangh.com PO Box 7400, Centurion, South Africa, 0046 International +27 21 940 6013 www.metropolitan.co.za Eris Property Group +27 11 775 1000 www.eris.co.za Guardrisk +27 11 669 1000 www.guardrisk.co.za Namibia [email protected] +264 61 297 3000 www.metropolitanna.com Hello Doctor +27 87 2300 002 www.hellodoctor.co.za [email protected] @Hello_DoctorSA Metropolitan Retail +27 21 940 5911 www.metropolitan.co.za [email protected] @MetropolitanZA https://www.facebook.com/ Botswana MetropolitanIIYF +267 362 4700 www.metropolitanbw.com Metropolitan Health +27 21 480 4511 www.mhg.co.za [email protected] Momentum Retail, +27 12 671 8911 www.momentum.co.za Out-come Based Solutions, @Momentum_za Employee Benefits www.facebook.com/ MomentumZAMomentum_za Momentum Asset Management +27 11 505 1000 www.momentum.co.za/investments 34

United Kingdom +44 20 618 1803 www.momentumgim.co.uk India +91 22 6625 8600 Zambia +260 211 236218 +234 01 277 2520 www.metropolitanzm.com www.ubametropolitan.com Kenya +254 20 224 3126/42/58 www.metropolitan.co.ke Tanzania +255 22 212 0113 www.metropolitantz.com Malawi +265 17 71 977/8/9 www.metropolitanmw.com +264 61 297 3000 www.metropolitanna.com Moçambique Mauritius +258 213 5 7800 +230 403 5200 www.metropolitanmz.com Lesotho www.metropolitanmu.com +266 22 22 2300/2100 www.metropolitanls.com South Africa Swaziland +268 2404 1369 +27 12 671 8911 www.metropolitansz.com www.mmiholdings.com 35

Our Footprint 36

www.mmiholdings.com